How can medium-sized companies benefit from the Amazon marketplace?

The Amazon marketplace represents dynamism, growth, and change: this can be both a blessing and a curse. In addition to many success stories, one reads equally chilling stories from product and account bans to the end of entire businesses. Many midsized companies and corporations are (still) faced with the question: Amazon, yes or no? Discussing exactly how and when it is worthwhile using Amazon as a sales channel, in this article experienced Amazon expert Manuel Kretschmer will explain the key factors in depth.

A similar version was published in the magazine Website Boosting on December 10th, 2019.

Read the entire article below, or click here to see the PDF version:

How can medium-sized companies benefit from the Amazon marketplace

Reading time: 15 minutes

Marketplace Amazon: The top dog in e-commerce

When you think of Amazon, you probably have many different services in mind.

Starting with AWS cloud hosting, to Amazon Alexa via PRIME Video, all the way to the Amazon marketplace, where primarily physical products of all kinds are offered.

To be exact, Amazon is the world’s largest online marketplace and at the same time the largest product search engine in the world.

56% [1] of all online product searches start directly on Amazon and in almost all cases they end with a purchase. Additionally, according to a study by IFH Cologne [2], half of all online shoppers first research on Amazon before making an online purchase.

The overall appearance of the product and brand plays a decisive role, as do product reviews and the price.

In a dynamic and very complex process, the Amazon A9 algorithm determines the relevance of a product to the respective search terms, such as “bath mat set 3-part”.

With the help of various optimization procedures, so-called Amazon dealers (independent sellers) and vendors (B2B partners of Amazon, mostly manufacturers and suppliers) fight for visibility and rankings on the first page of the respective search results.

For many medium-sized companies and corporations, however, the subject of “selling on Amazon” is still a big thorn in the side.

On the one hand, there are unfortunately still some companies that have almost completely missed digitization. The companies are often complete professionals in their specialty, e.g. in shops and stationary trade. However they may lack the necessary e-commerce know-how, staff capacity, and entry funds – in these respects, entry to e-commerce can be very expensive.

However, it can also be observed that some medium-sized companies have already dared to take the first successful steps in e-commerce, yet are still viewing the topic of Amazon with caution or skepticism – and not without good reason, because selling on Amazon harbors risks and challenges as well as great growth potential with it. This includes the fear of becoming dependent on Amazon, the loss of control over the sales channel, the fear that the brand image will be damaged, a significantly lower margin than in the online shop, and, last but not least: the fear of cannibalizing their other sales channels.

Furthermore, the products of some medium-sized companies are already available on Amazon, but they have been placed on Amazon by authorized and unauthorized retailers of said brand. However, since there is no uniform strategy and planning, only parts of the range are available on Amazon and the respective product information seems sloppy.

It is important to understand that each product can or may only be available once on Amazon. For example, if 20 different retailers offer an identical shoe brush, the Amazon customer will still only find this specific shoe brush once.

Only one of the 20 dealers can win the shopping cart field, the so-called “buy box”.

Winning the Buy Box is a prerequisite for end customers to be able to order the product with one click. There is now a battle for the shopping cart field among the remaining 19 retailers, which can be won primarily through a better price. However, other factors also play a decisive role, such as sales performance.

This is only logical because only one thing counts for Amazon: guaranteeing the end customer the most convenient and best possible shopping experience. If a seller regularly replies too late to customer messages and sometimes delivers orders too late, this will worsen the customer’s shopping experience. In addition, every retailer must enter important product information when creating the products, such as a title, five bullet points, a product description, keywords, notes, and images. In this case that we’ve been discussing, Amazon receives different product information for just one product up to 20 times and reserves the right to decide for itself which information is now displayed to the end customer – and not just once, but consistently around the clock.

This means that very different product information can be displayed today than what will be shown tomorrow. Naturally, this chaos is a horrifying prospect for a diligent brand owner.

And the medium-sized company owner? They look at this whole situation from the outside and see how their careful pricing policy and uniform product information are now up in smoke. But that doesn’t have to be the case, because there is a solution for (almost) all challenges when selling on Amazon. More on that later…

Selling on Amazon: Unused potential, Amazon FBA, the Amazon Buy Box

Regardless of which view you take on Amazon, you want to gain a foothold in e-commerce. Therefore you can no longer avoid the top dog: Amazon. Amazon understood how e-commerce works and essentially perfected its customer strategy earlier than any other marketplace or online shop. It’s possible to philosophize about strategies, master SEO (search engine optimization) and advertising (advertising formats) perfectly, and measure and optimize using countless KPIs (performance indicators) – and still fail in e-commerce.

Because first and foremost, it is only a matter of satisfying the end customer.

This is achieved by creating trust, having a clear – and above all short – customer journey (the customer’s journey from search to purchase), attractive prices, but also through short shipping times, accommodating customer service, and very high reliability. Amazon offers the greatest variety of products at the most attractive prices with the most convenient shopping experience (1-click order) and the shortest shipping time (same-day delivery).

It is very important to understand that Amazon does not see its dealers and vendors as customers, but rather as a means to an end. But here, too, it doesn’t matter how you personally feel about it, because over 44 million customers [3] with a high purchase intention are waiting on the Amazon marketplace in Germany alone.

According to the Federal Association of E-Commerce and Mail Order, more than half of online sales in Germany were made there in 2016 alone. [3] Based on these figures, it is easy to see that customers have a very high level of trust in the Amazon marketplace, and there is gigantic growth potential.

In addition, many customers use Amazon as a reference for their research.

For example, if a customer discovers a product in a speciality store, stationary trader, or in an online shop, they next go to Amazon to read through the product information, ratings, and customer opinions and to price compare.

So it makes perfect sense to classify, optimize and maintain Amazon as the digital business card of your own brand. For this purpose, Amazon provides the brand owners with the so-called “brand registry”. With a registered trademark, the trademark owner now has the opportunity to obtain sovereignty over all products and brand information.

This step is the absolute basic requirement for successful selling on Amazon.

Regardless of which product information has already been uploaded by the retailers or how the products have been grouped, the brand owner determines the appearance of the brand on Amazon from this point in time. From here, the necessary Amazon know-how should be built up internally or purchased externally. Many years of experience with dozens of retailers and vendors have shown that Amazon strategy should be developed together with an Amazon expert from the very start. The Amazon marketplace is fundamentally too complex to understand, let alone optimize, with just a little research or even an introductory workshop.

Selling on Amazon: The Pricing Policy

Another point that cannot be resolved immediately with a brand registry is the issue of sales prices.

A distinction must be made here between dealers and vendors. As a seller (dealer) you can sell your own products to end customers via the marketplace. You can send the goods yourself or use Amazon’s logistics with the Amazon FBA (Fullfilment-By-Amazon) program.

As a seller, you determine all product information, stock levels, and, above all: the price, yourself. You could therefore propose that as a seller, after a successful brand registry, that you have full control over the brand. If you do not supply any other distributors or authorized dealers who in turn sell the goods on Amazon, this is usually the best solution to tackle the Amazon sales channel.

In most cases, however, medium-sized companies are faced with a completely different situation and various traders that sell the goods will be fighting for the buy box.

If this is the case, there is no way around the vendor program – provided you are interested in generating the sales on Amazon yourself. It can also be a viable strategy to optimize and maintain the digital business card but handle all Amazon sales through authorized dealers. The vendor program is specially tailored to medium-sized companies and corporations. The greatest advantage here is that Amazon itself acts as the seller and can win the buy box even if the sales price is higher, and the end customer has greater confidence in the product if it is sold directly by Amazon. The pricing policy cannot be completely controlled, but experience has shown that the problems can be greatly reduced.

It is important to know the different methods how, as a medium-sized company, to control the Amazon sales channel yourself and to maintain the brand’s image.

Cannibalize other sales channels

Assuming that the points described previously have been taken seriously and implemented, the question still arises whether the Amazon sales channel is really an asset to the brand.

The fear of cannibalizing other sales channels, that is to say simply redistributing total sales instead of gaining new customers and thus becoming dependent on Amazon with a lack of access to customers, prevails. A marketplace study from 2017 by Arvato SCM Solutions [4] has shown why this concern is unjustified, and that even the opposite is the case.

This also coincides with the many years of experience of the Amazon agency ama-X from Munich. Accordingly, when connecting to marketplaces such as Amazon, sales increases of up to 15% are possible. This is primarily due to the fact that 95% of marketplace customers shop almost exclusively on marketplaces such as Amazon. This means that the proportion of hybrid customers who buy on both channels is only 5%.

It is even more interesting to look at the entire customer base. It turned out that the proportion of “immigrants” among the hybrid customers who placed their first orders at the marketplace and then bought them in the branded shop, at 15%, was significantly higher than the proportion of “emigrants” (6%).

Effect of the ranking system

For a final evaluation, it is also important to understand how the visibility of the products on Amazon comes about and what this means for planning security.

Behind the Amazon marketplace is a complex algorithm with a ranking system.

Products that sell the most units via a specific keyword (search term) therefore have the highest relevance for the respective keyword. In short: a vicious circle. Who sells the most is right at the front and only those who are at the front can expect significant sales figures.

With the right Amazon strategy and targeted optimizations, medium-sized companies can still escape the vicious circle and create sustainable growth on the Amazon marketplace.

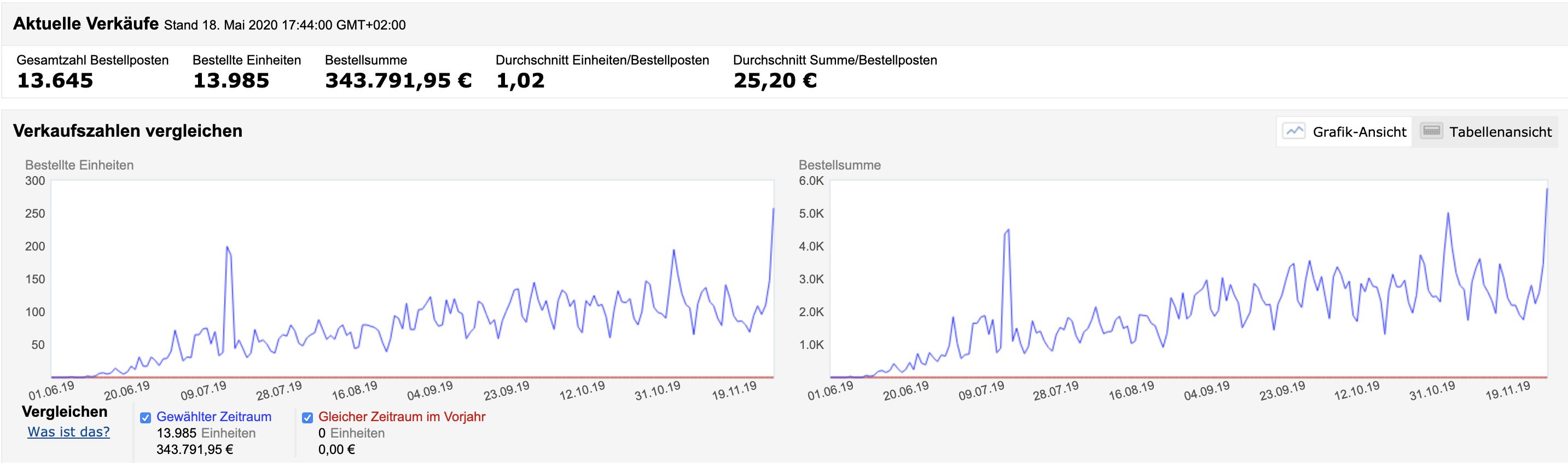

Those who master this challenge and have a functioning strategy will benefit from the ranking system and can look forward to a stable new sales channel and sometimes tens of thousands of new customers.

Rankings on the first page of search results mean predictable sales.

In particular, brands that already have good branding outside of Amazon find it much easier to start on Amazon. Brand-related search queries and buyers are already available before sales start and ensure better product visibility right from the start. The goal of a ranking-controlled marketplace like Amazon, however, is to rank for generic search terms without explicit brand names – for example, “running shoes”.

According to an article in the New York Times [5], this is precisely a noteworthy factor of the Amazon marketplace, because around 70% of all search queries on Amazon are generic. Amazon customers already know what type of product they are looking for and make their purchase decision independently of the brand awareness.

The Amazon marketplace requires very good planning

If a medium-sized company is considering selling its own products on the Amazon marketplace, it should primarily mean the following: all or nothing. “All” does not mean the exclusive sale of a brand on Amazon, nor does it mean the sale of all of the brand’s products on Amazon.

Rather, it means understanding the complex processes and rules of the platform, classifying the Amazon strategy in the overall context of the brand, and having technical expertise in the field of Amazon SEO and Amazon advertising at hand. This starts with the question of how the Amazon marketplace should be used.

Selling Successfully on Amazon: A Brief Checklist

✅ The digital business card Amazon must be maintained, regardless of whether the sales are to be generated by the brand owner himself. The prerequisite for this is the Amazon Brand Registry.

✅ If the products of a brand are also sold by authorized dealers of the brand via Amazon, while the brand owner wants to generate sales himself, with the lowest possible risk of getting into a price war against his own dealers, then a B2B partnership with Amazon as a vendor is recommended.

✅ All or nothing. Growth on Amazon requires professional support or experienced in-house employees, as well as internal capacity for content, images, and day-to-day Amazon business management. Professional support should already be available when setting up the seller account, negotiating conditions with Amazon in the vendor program, and selecting the products.

✅ Less is more. The right product selection is the prerequisite for successful growth on Amazon. The existing product range should be divided into different priority levels. Experience has shown that it is advisable to focus a maximum of 20 product families with all measures simultaneously. If an article does not develop as desired despite joint implementation with an Amazon expert or an Amazon agency and with a clear optimization system in place, the affected articles should be replaced after three months at the latest.

✅ Amazon is a data-driven company and should be treated as such. With the help of key tools, all relevant KPIs can be efficiently tracked and evaluated. Data should be the basis for optimization and strategic decisions.

Good luck selling on Amazon!

Sources:

[1] Cf. Geiger, Lisa: “Amazon is replacing Google as the largest product search engine”, in: Lead Digital, April 23, 2019, [online] https://www.lead-digital.de/amazon-loest-google-als -large-product-search-engine-from / [13.11.2019].

[2] Cf. Stüber, Dr. Eva / Carolin Leyendecker: The Amazon Offensive, in: IFH Cologne, April 27, 2018, [online] https://www.ifhkoeln.de/blog/details/die-amazon-offensive/ [November 13, 2019].

[3] Cf. Kroker, Michael: Amazon in Germany: 44 million customers – including 17 million Prime users | Kroker’s Look @ IT, in: Wirtschafts Woche, May 18, 2016, [online] https://blog.wiwo.de/look-at-it/2016/05/18/amazon-in-deutschland-44-millionen-kunden -of-17-million-users-of-prime / [11/13/2019].

[4] Cf. Tietjen, Immo: marketplaces for fashion brands, in: Arvato Bertelsmann, July 31, 2017, [online] https://arvato-supply-chain.com/fileadmin/scm/de/Landing_Pages/whitepaper/Fashion__Beauty___Lifestyle/Arvato_ -_Marktplaetze_fuer_Modemarken__1 __-_ DE.pdf [11/13/2019].

[5] Cf. Creswell, Julie: How Amazon Steers Shoppers to Its Own Products, in: New York Times, June 25, 2018, [online] https://www.nytimes.com/2018/06/23/business/amazon -the-brand-buster.html [11/13/2019].